Managing finances effectively is essential for the survival and growth of any small business. Whether you’re a sole trader, startup, or growing enterprise, choosing the right accounting software can help you streamline invoicing, track expenses, manage taxes, and make smarter financial decisions. In today’s digital-first world, small business owners need efficient, cloud-based tools that are affordable, scalable, and easy to use.

In this comprehensive guide, we break down the best accounting software for small businesses in 2025, covering features, pricing, pros and cons, and who each platform is best suited for. This article is designed to help you make an informed decision that aligns with your specific business needs.

As more businesses transition to digital tools, accounting software has become more than just a bookkeeping utility—it’s a business growth enabler. From real-time financial reporting to seamless tax compliance, modern platforms are built to meet the evolving demands of small businesses in a competitive marketplace.

In this guide, we’ll explore the top accounting software choices for 2025, helping you identify which tools offer the best features, support, scalability, and value for your business. Whether you’re seeking a free solution to get started or a robust system for a growing enterprise, you’ll find an option that fits your needs.

Why Accounting Software Matters for Small Businesses

Accounting software can dramatically reduce the manual effort required for bookkeeping and financial reporting. Here’s how it can benefit your business:

- Time savings: Automates tasks like invoicing, payroll, and bank reconciliation.

- Accuracy: Minimizes human error with built-in calculations and validations.

- Tax readiness: Generates tax reports and integrates with HMRC or IRS systems.

- Insights: Provides dashboards and analytics for better financial planning.

- Collaboration: Allows accountants and team members to access real-time data securely.

What to Look for in Small Business Accounting Software

When evaluating accounting software options, consider the following criteria:

- Ease of Use

You want intuitive navigation, minimal setup, and user-friendly dashboards. This is particularly important if you’re not from an accounting background.

- Features

At a minimum, look for invoicing, expense tracking, bank feeds, financial reporting, and tax calculation. Advanced features include inventory management, payroll integration, and multi-currency support.

- Scalability

Choose a solution that can grow with your business. Look for software with tiered plans or add-on features.

- Cost

Software pricing should align with your budget. Some platforms offer freemium models or free trials.

- Integrations

Ensure compatibility with other business tools like CRM, payment gateways, and ecommerce platforms.

- Customer Support

Responsive customer support can be crucial when issues arise. Check for live chat, email, or phone support.

Best Accounting Software for Small Businesses in 2025

1. QuickBooks Online

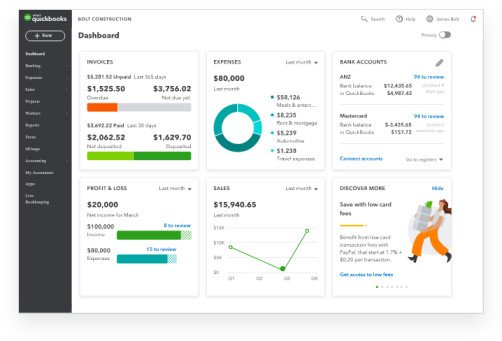

Both small and large enterprises can benefit from the different options offered by QuickBooks, either through cloud-based or desktop accounting. QuickBooks assists smaller organizations with their time management and overall organization through its streamlined features. For freelancers, growing businesses, or team leaders, staying on top of finances is especially easy with flexible tools available in QuickBooks Online.

Best for: Most small businesses

Key Features:

- Invoicing and estimates

- Expense and mileage tracking

- Payroll and tax management

- Integration with 750+ apps

Pricing: Starts at $30/month; Advanced plan goes up to $200/month

Pros:

- Industry leader with comprehensive features

- Strong mobile app

- Frequent updates

Cons:

- Can get expensive as your business grows

- Steeper learning curve for beginners

2. Xero

Xero targets small businesses looking for cloud-based solutions as it helps them stay organized and manages their financial documents easily. Its reputation worldwide stems from a clean interface combined with powerful automation which makes it a favorite amongst startups, freelancers, and service-based businesses. With Xero’s cloud services you have the capabilities of managing your bookkeeping along with invoicing, inventory tracking, payroll (available in some countries), and taxation all at one place e-filed from anywhere in the world.

Best for: Growing businesses and teams

Key Features:

- Unlimited users in all plans

- Inventory tracking

- Financial reports and analytics

- Multi-currency support

Pricing: Starts at $13/month (Early), $37/month (Growing), $70/month (Established)

Pros:

- User-friendly interface

- Powerful reporting tools

- Strong app ecosystem

Cons:

- Limited features in lower-tier plans

- No native payroll outside select regions

3. FreshBooks

An easier life on the job as a small business owner comes with accessing an accounting solution like FreshBooks which assists you with overall document organization. Through cloud based solutions like this one entrepreneurs, consultants, and service based franchise owners can put most of their focus back into work by relieving themselves from excess financial paperwork. Having simple yet effective invoicing and time tracking available via mobile app or web page boosts productivity while waiting to be accessed whenever needed.

Best for: Freelancers and service-based businesses

Key Features:

- Time tracking and project billing

- Customizable invoices

- Expense tracking

- Client portal

Pricing: Starts at $17/month (Lite); $55/month (Premium)

Pros:

- Clean, intuitive UI

- Excellent customer service

- Strong for time-based billing

Cons:

- Not ideal for product-based businesses

- Charges extra for team members

4. Zoho Books

Zoho Books is an accounting application hosted on the cloud, created to assist small businesses in managing finances, automating workflows, and ensuring tax compliance within a single platform. Given that it is part of the Zoho ecosystem, it integrates well with other tools used by businesses. For freelancers, startups, or growing businesses, the range of features offered by Zoho Books aids in time savings, reduction of manual tasks, and improvement of financial decision making.

Best for: Businesses needing automation and custom workflows

Key Features:

- Automated workflows

- Client and vendor portals

- Project management

- Integrated with Zoho ecosystem

Pricing: Free for businesses under $50K revenue; paid plans from $20 to $275/month

Pros:

- Affordable and scalable

- Deep automation capabilities

- Supports multiple tax jurisdictions

Cons:

- Learning curve due to feature-rich platform

- Limited third-party integrations compared to others

5. Wave Accounting

Wave Accounting targets entrepreneurs, freelancers as well as small businesses with its cloud-based accounting software. It eliminates cumbersome spreadsheets and advanced accounting software through providing a range of tools for easy to use and efficient account management. As a result of being cloud based, Wave permits users to access their financial information from any location with internet connection. As such, business owners can efficiently oversee account management even while on the go , using desktops laptops or mobile devices.

Best for: Startups and micro-businesses on a tight budget

Key Features:

- Free invoicing and accounting

- Receipt scanning

- Basic reporting

Pricing: Free for core features; Payroll starts at $20/month

Pros:

- Completely free core accounting

- Simple and effective for basic needs

Cons:

- Limited customer support

- Lacks advanced features like inventory or time tracking

6. Sage Business Cloud Accounting

Sage offers both cloud-based and desktop-based accounting solutions to serve businesses of varied sizes. It is a well-reputed international supplier of business management systems because of its adaptable accounting solutions. Cloud-based Sage Accounting is best suited for freelancers and small businesses. For other businesses with more sophisticated needs, Sage 50 offers a robust desktop solution. It is designed for small to medium-sized enterprises that demand sophisticated accounting features such as comprehensive financial reporting, inventory control, job costing, and advanced managerial analytics.

Best for: UK-based businesses with tax and compliance needs

Key Features:

- Making Tax Digital (MTD) compliant

- Cash flow forecasting

- Invoicing and payments

- Inventory management

Pricing: Starts at $10/month (Start); $25/month (Standard)

Pros:

- Robust compliance features

- Long-standing reputation

Cons:

- Interface not as modern

- Customer support can vary

7. FreeAgent

Best for: Contractors and consultants (especially in the UK)

Key Features:

- VAT, self-assessment, and payroll tools

- Real-time bank feeds

- Automated tax calculations

Pricing: Starts at $24/month; free with certain banking partnerships

Pros:

- Built with freelancers in mind

- Great for tax filing in the UK

Cons:

- Not suitable for larger businesses

- Limited integrations

How to Choose the Right Accounting Software for Your Business

- Assess Your Needs: Start by listing out your core accounting requirements.

- Set a Budget: Decide how much you’re willing to spend monthly.

- Take Advantage of Free Trials: Most providers offer at least a 14-day trial.

- Test the Interface: Make sure the platform feels intuitive and manageable.

- Read Reviews: Look at trusted review sites like G2 or Capterra.

Frequently Asked Questions

What is the easiest accounting software to use?

FreshBooks and Wave are known for their user-friendly interfaces, ideal for beginners and non-accountants.

Can I do my own accounting as a small business owner?

Yes, with the right tools, many small business owners handle their own accounting. However, consulting an accountant during setup or tax season is still advisable.

Is free accounting software good enough?

Wave and Zoho Books’ free plans can be sufficient for freelancers or very small businesses. However, growing companies may need paid plans for added features.

Can accounting software help with taxes?

Yes. Most platforms offer tax reports, VAT/GST calculations, and direct filing integrations with tax agencies.

What happens if I switch software later?

Most platforms allow data exports/imports. However, it’s best to switch at the end of a fiscal period to simplify recordkeeping.

Conclusion

Selecting the best accounting software for your small business is a decision that impacts your daily operations and long-term growth. With a wide range of options—each catering to different needs and budgets—you’re sure to find a solution that fits your business model.

QuickBooks and Xero remain strong all-rounders, while Zoho Books and FreshBooks cater to niche requirements. Meanwhile, Wave provides unbeatable value for small operations. Take the time to evaluate your specific needs, explore free trials, and choose a platform that offers both functionality and room to grow. With the right accounting software in place, you can save time, reduce errors, and gain better control over your financial future.