The move to working remotely has forever altered the way companies relate and work with their workforce. Distributed teams are the new normal and with them comes the rising interest in flexible, compliant and borderless workforce-designed payroll systems. It is no longer easy to manage the salaries, taxes and benefits of working employees in various states or countries. Conventional payroll instruments are usually inadequate, causing issues of regulatory non-compliance, inaccuracies in the payment of taxes, and poor employee satisfaction.

Payroll services to remote working teams are where it comes in. These new solutions are aimed at making cross-border payroll more manageable, enforcing local labour regulations without the need to hire specialist labour counsel and paying employees on time and wherever they are.

The following article goes in-depth into the topic of payroll services for remote teams in 2025, discussing why remote payroll services are relevant, what advantages to expect, the top providers, and how to select the one to suit your company needs.

Why Remote Teams must have Payroll Services?

The new normal is global workforces

The cost of hiring globally has acquired a competitive benefit. Most companies are now using international talent and this includes startups and established businesses. As this widens the workforce, it also makes payroll a complex task since:

- All nations have distinctive tax laws.

- Multiple currencies have to be dealt with.

- There is broad and uneven labor law compliance.

Difficulty of Tax Supervision

It is dangerous to handle tax laws manually in various regions and it is time-consuming. Companies will suffer penalties because of faults and delays in payments. Payroll systems that support remote teams automate tax calculations and Payment of taxes and adhere to local rules.

Various Job Titles

Remote teams tend to be composed of both full time employees, contractors and freelancers. An efficient system of payroll must process various payment systems, invoicing and benefits in an organized manner.

Experience and Retention of Employees

The workers want to receive the payments on time, clearly displayed on payslips, and access to self-service portals. An effective payroll service will increase trust and retain remote teams.

Important Payroll Services Characteristics to Search in Remote Team

Payroll software checklist: Whenever you are reviewing payroll software, here are the features you should look out when conducting reviews:

1. Global Payroll Coverage

Make sure that the service will be able to accept payments in several countries and currencies and across banking systems. Such platforms as Deel or Remote are specialized in this.

2. Employer of records (EOR) Services

In the case of companies that are not looking to establish a legal presence in the country of employment, the EOR services will enable hiring employees in a compliant manner.

3. Compliance Automation

Seek automatic changes in the local labor laws, tax deduction, and social security contribution. This alleviates the risk of compliance.

4. Multi-Currency Payments

The remote teams usually work on a global basis. The payroll services must facilitate the currency conversion and low-cost international payments.

5. Self-Service Portals

The usage of secure dashboard must allow the employees to view, modify personal information, and control taxes and payslips.

6. HR and Accounting Systems Integrations

Connects easily to HRIS (Human Resource Information Systems), accounting, and time-tracker programs to save time and eliminate mistakes.

7. Scalability

Select a platform that will scale with your enterprise. Your starting point might be 10 employees or 500 in several countries but the system must be able to adjust.

8. Safety and Privacy of Data

Payroll is covered with sensitive employee information. Make sure that the provider is GDPR, SOC 2, and other foreign data protection compliance.

How to Choose the Right Payroll Service

With myriads of choices, how do you choose the correct payroll system to use in responding to a remote team?

Step 1: Evaluate the Geographic Distribution of Your Team

When you do have staff in several countries, the global reach of platforms such as Deel, Remote or Velocity Global are prioritized.

Step 2: Find your Employment Model

- Mostly contractors? Pick Multiplier or Deel.

- Full time employees globally? May be better in remote or velocity global.

- U.S. centered teams? Gusto or ADP will do.

Step 3: Look at our Budget

Others include bundled services and some platforms charge per employee per month. Compare the pricing structure and make sure that the platform can grow according to the number of people associated with the team.

Step 4: Look at the Integrations

Make sure your payroll product has the ability to interface with your current HR software, accounting programs, and communication sector.

Step 5: Make compliance and security a priority

Select platforms that have established a good track record of compliances and have the capability of safe management of sensitive payroll information.

15 Best Alternatives to Payroll Services for Remote Teams

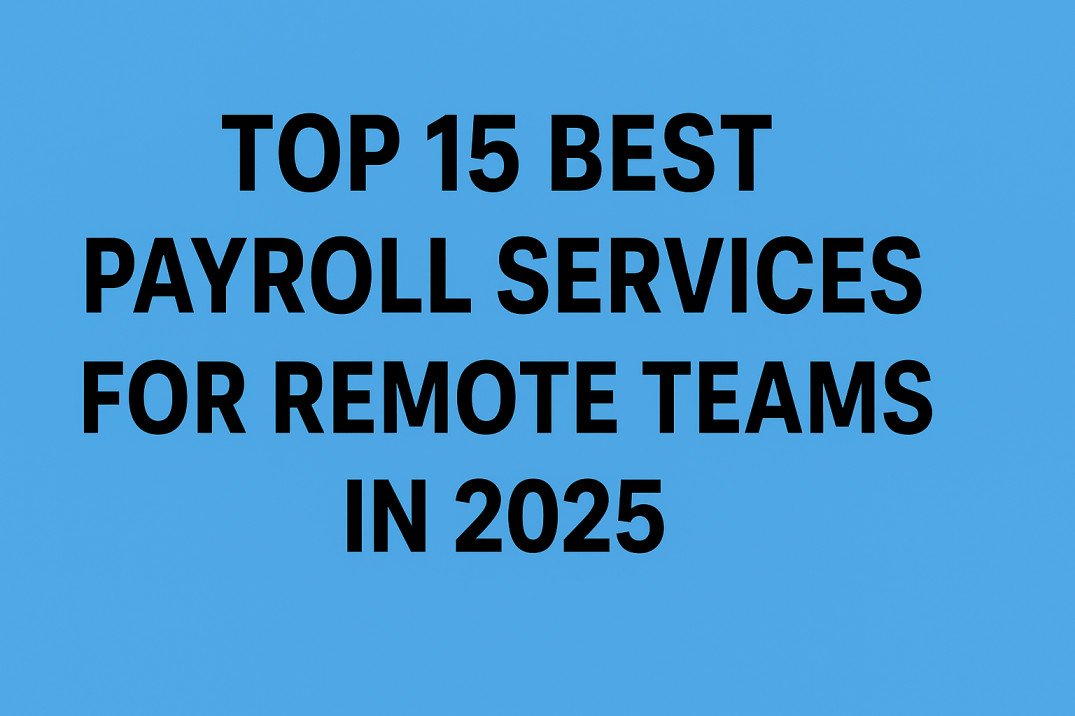

1. Justworks (PEO)

Description: A Professional Employer Organization that combines payroll, HR, compliance, and benefits into one platform.

Features: Payroll automation, benefits administration, tax filing, compliance support.

Pros:

-

User-friendly interface

-

Great customer support

-

Provides access to big-company benefits

Cons:

-

Only available in the U.S.

- Can be expensive for very small teams

Pricing: Starts at $59 per employee/month.

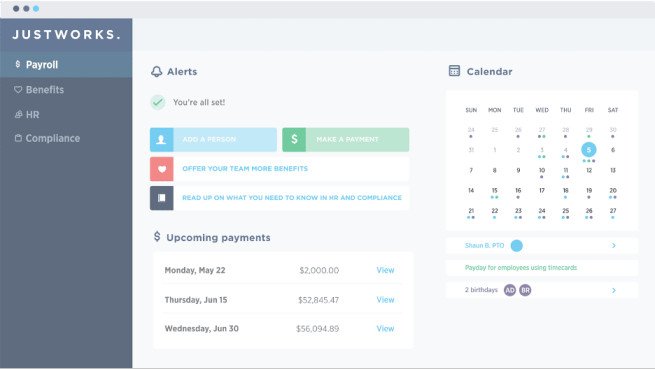

2. TriNet (PEO)

Description: A well-known PEO offering payroll, HR, risk management, and compliance.

Features: Payroll processing, benefits, tax compliance, HR consulting.

Pros:

-

Access to top-tier health insurance plans

- Industry-specific HR support

Cons:

-

Pricing isn’t transparent

- May feel complex for startups

Pricing: Custom quote only (average around $150–$200 per employee/month).

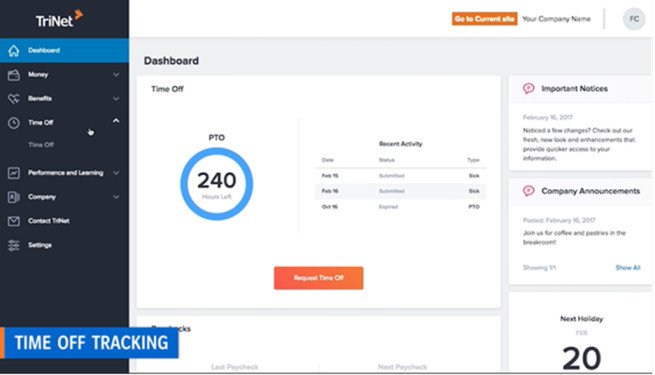

3. Insperity (PEO)

Description: A full-service HR and payroll provider designed for small to medium-sized businesses.

Features: Payroll, compliance, risk management, HR technology.

Pros:

-

Strong compliance expertise

- Scalable HR solutions

Cons:

-

Pricing is higher than standalone payroll

- Contract length is restrictive

Pricing: Custom pricing; usually $230+ per employee/month.

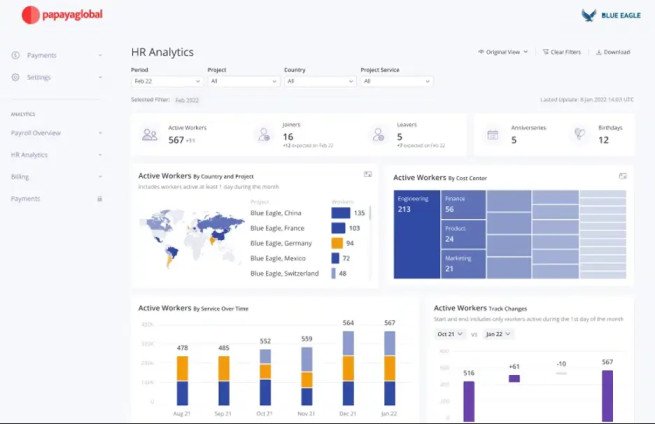

4. Papaya Global (EOR)

Description: A global Employer of Record that simplifies international hiring without setting up entities.

Features: Global payroll, local compliance, benefits administration.

Pros:

-

Covers 160+ countries

- Great for scaling internationally

Cons:

-

Not ideal for companies only hiring locally

- Pricing is higher per employee

Pricing: Starts at $650 per employee/month.

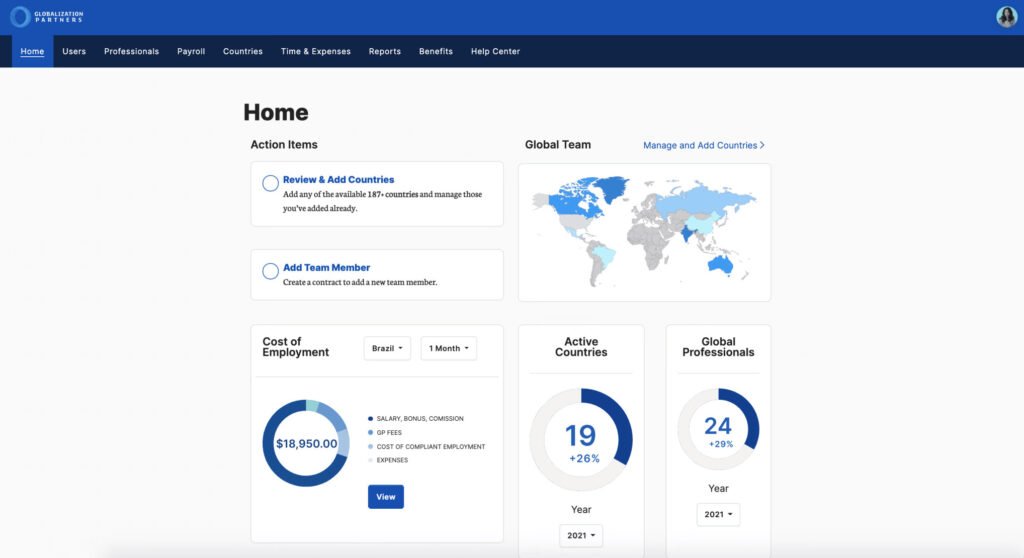

5. Globalization Partners (EOR)

Description: A leading EOR platform for hiring and paying global employees compliantly.

Features: Employee onboarding, payroll, tax compliance, benefits.

Pros:

-

Fast international hiring

- Handles complex compliance tasks

Cons:

-

Premium pricing

- Less flexible for contractor-only teams

Pricing: $599–$999 per employee/month.

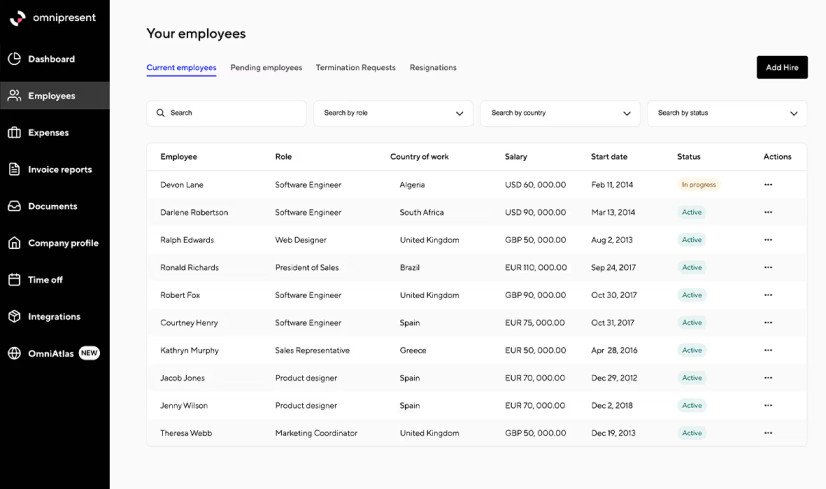

6. Omnipresent (EOR)

Description: Focused on remote-first companies needing help with global compliance and payroll.

Features: International payroll, tax compliance, benefits management.

Pros:

-

Fully remote company model

- Localized support in 150+ countries

Cons:

-

Higher cost compared to basic payroll tools

-

Limited for purely U.S.-based firms

Pricing: From $650 per employee/month.

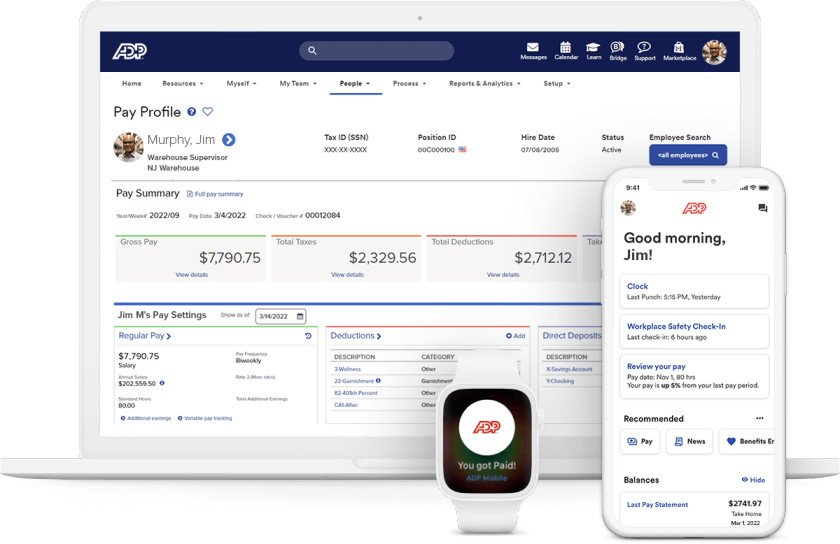

7. ADP Global Payroll

Description: One of the most recognized payroll and HR providers with global coverage.

Features: Multi-country payroll, compliance, HR management.

Pros:

-

Highly reliable and trusted brand

- Strong compliance infrastructure

Cons:

-

Expensive for small businesses

- Interface feels outdated compared to modern tools

Pricing: Custom pricing; typically $80–$150 per employee/month.

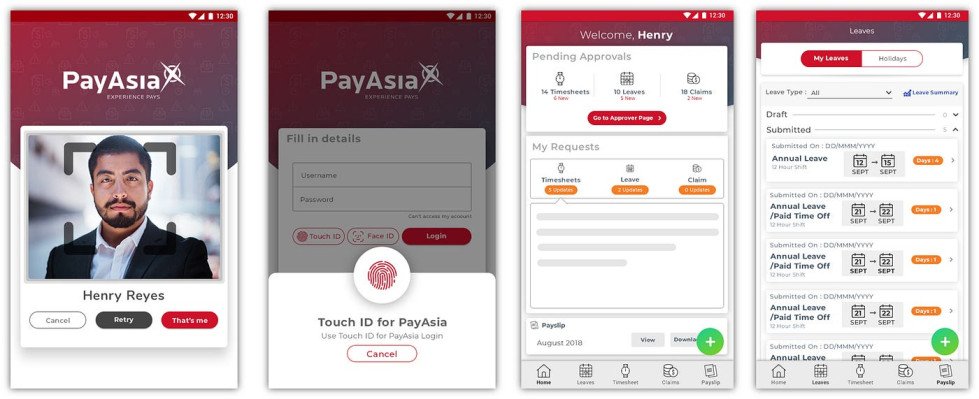

8. PayAsia

Description: Regional payroll and HR solution for Asia-Pacific markets.

Features: Payroll processing, HR automation, compliance support.

Pros:

-

Strong APAC expertise

- Local tax and compliance handled

Cons:

-

Regional focus (not truly global)

- Requires integration with other HR tools

Pricing: Custom pricing; generally $30–$80 per employee/month.

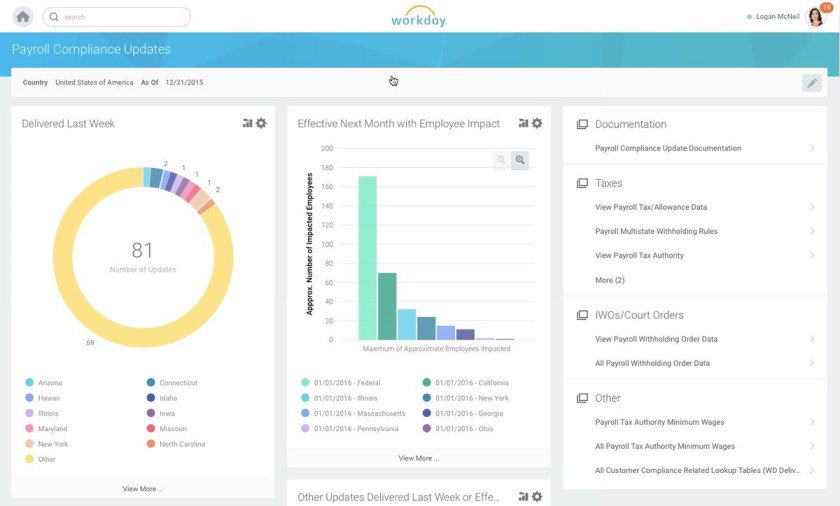

9. Workday

Description: An enterprise-grade HR and payroll platform used by large corporations.

Features: HR management, payroll, workforce planning, analytics.

Pros:

-

Extremely comprehensive HR suite

- Powerful analytics and reporting

Cons:

-

Very expensive

- Steep learning curve

Pricing: Custom enterprise pricing; often $200–$300 per employee/month.

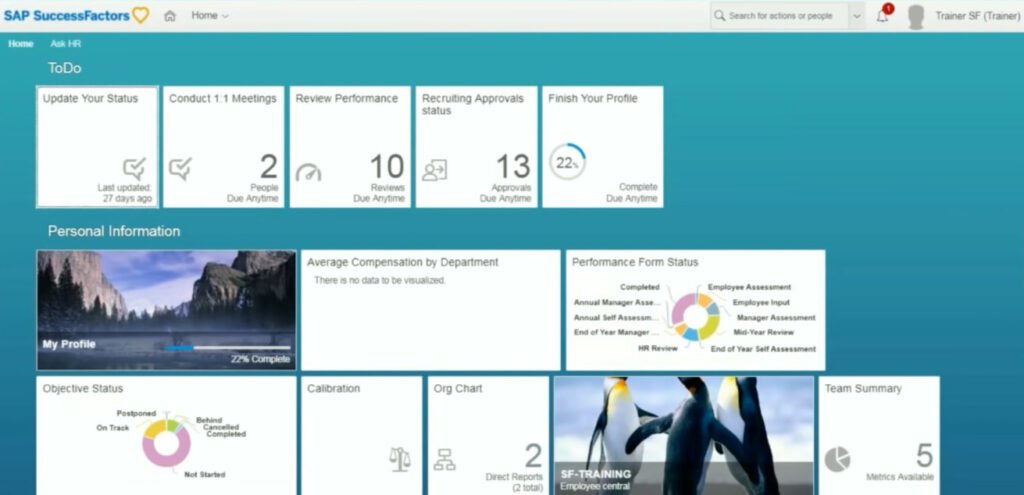

10. SAP SuccessFactors

Description: Enterprise HR software with integrated payroll modules.

Features: HR management, global payroll, compliance tools.

Pros:

-

Robust, scalable enterprise system

- Global compliance and localization

Cons:

-

Expensive and complex to implement

- Best for enterprises only

Pricing: Custom pricing; often $100–$250 per employee/month.

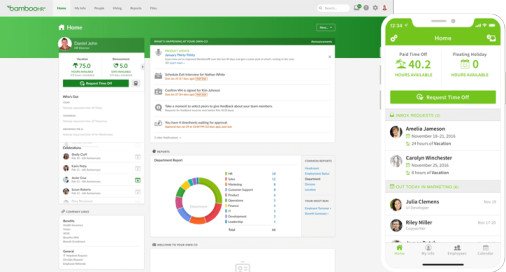

11. BambooHR

Description: A popular HR software for small and mid-sized businesses with payroll as an add-on.

Features: Employee database, onboarding, payroll, time tracking.

Pros:

-

Very user-friendly

- Affordable compared to enterprise tools

Cons:

-

Payroll only available in the U.S.

- Not ideal for large global teams

Pricing: Starts at $8.75 per employee/month + payroll add-on.

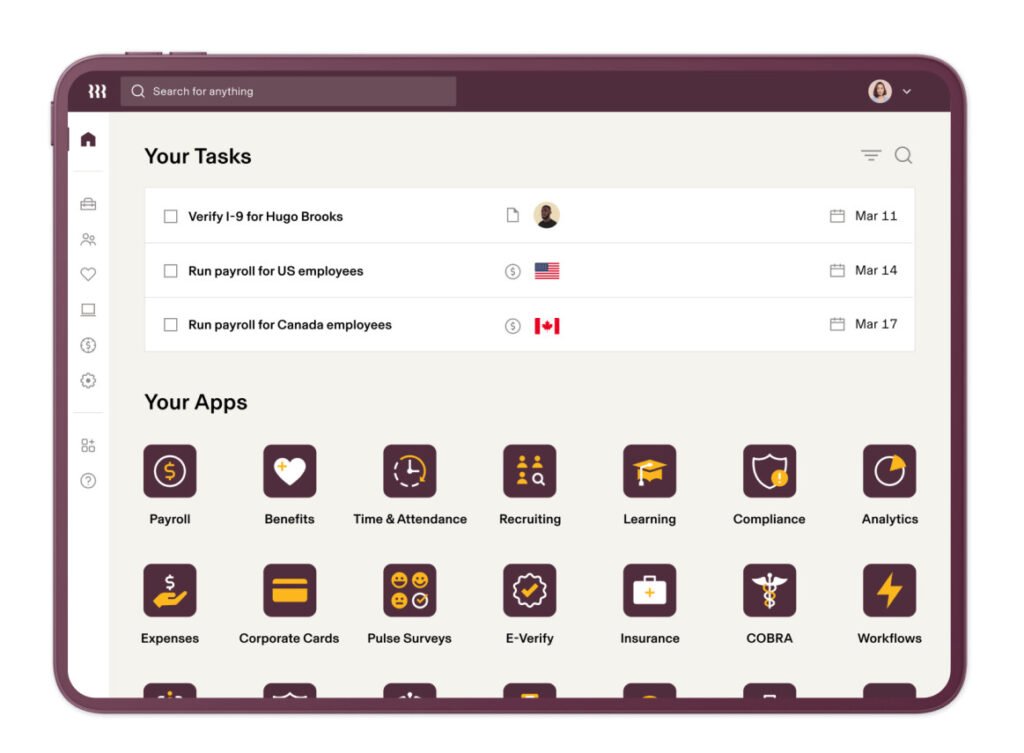

12. Rippling

Description: An all-in-one platform combining HR, payroll, benefits, and IT.

Features: Global payroll, employee onboarding, compliance, device management.

Pros:

-

Seamless automation across HR and IT

- Global capabilities

Cons:

-

Add-ons increase overall cost

- Learning curve for smaller companies

Pricing: Starts at $8 per employee/month + add-ons.

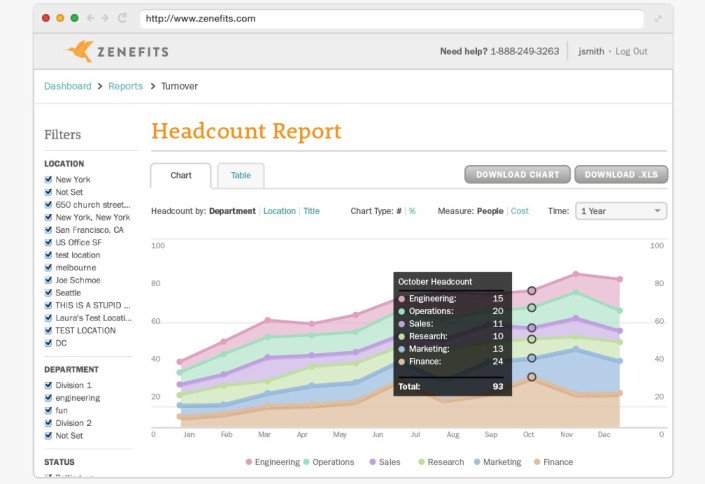

13. Zenefits

Description: HR platform with modular payroll options for SMBs.

Features: HR management, payroll, compliance, benefits enrollment.

Pros:

-

Flexible and scalable

- Affordable for startups

Cons:

-

Payroll isn’t included by default

- Limited for international teams

Pricing: Starts at $10 per employee/month + $6 payroll add-on.

14. Payoneer

Description: A global payments platform for contractors and freelancers.

Features: Cross-border payments, invoicing, multi-currency accounts.

Pros:

-

Low-cost international transfers

- Supports freelancers and vendors worldwide

Cons:

-

Not a full payroll solution

- Limited HR features

Pricing: Transaction-based fees (typically 1–3% per transfer).

15. Wise Business (formerly TransferWise)

Description: A cost-effective platform for international contractor and freelancer payments.

Features: Multi-currency accounts, international transfers, expense tracking.

Pros:

-

Very low fees compared to banks

- Transparent exchange rates

Cons:

-

Not a complete HR/payroll solution

- No tax filing or compliance support

Pricing: Transfer fees start at 0.41% per transaction.

Examples of Real World Problems with remote payroll

Despite the use of sophisticated programs, some of the issues that businesses can experience include:

- Exchange rates on salaries.

- Different employment classification in the different countries.

- Slowness in the payment of cross-border payments.

- Benefits/Compensation expectations differences.

- The risks can be reduced with the help of a strong payroll partner, who provides the local expertise and automation.

FAQs

1. How can Employer of Record (EOR) be distinguished from payroll software?

Payroll software accomplishes the payment of the salaries, taxes and allotments. An EOR, instead, has a legal employment agreement of the workers in your behalf legally in one of the countries where you do not have an entity and they are compliant.

2. Are payroll services able to pay full-time employees and contractors?

True, the majority of contemporary platforms allow supporting diverse employment forms, which is why they are especially suitable in the case of remote, mixed-structure teams.

3. What are the prices of remote team payroll services?

Prices are dependent, but payroll services would cost an employee about $20 to 50 dollars monthly, whereas employing an EOR service can run into the 300-600 dollars-per-employee monthly price range.

4. Are taxes automated in payroll services?

Yes. The prominent platforms make automated tax calculations and filing in accordance with the local laws, minimizing compliance threats.

5. Does payroll service have security?

The best vendors follow global information security regulations (GDPR, SOC 2, ISO 27001) to safeguard the sensitive employee information.

Conclusion

Remote payroll services can not be an option anymore, it has become necessity. With business growth across the borders, reliable payroll solutions are necessary to meet compliance and accuracy levels of payments needed to satisfy the workforce. The proper service can save hours and it can save risks and employees can get paid right and get paid on time no matter where a person is located.

Questions to ask yourself when selecting a provider would include the geographical location of your team, employment type, budget and the need of integration. Deel, Remote, and Velocity Global are the leaders of global payroll, over Gusto and ADP that are good on domestic ones. Businesses that invest in the correct payroll service can, therefore, devote their time to expansion and new ideas, and can turn the burden of the payroll to recognized experts.